US proposed import levy looks like a not-so disguised carbon tax

This analysis is by Bloomberg Intelligence Government Andrew Silverman. It appeared first on the Bloomberg Terminal.

A proposed levy on a broad range of imports is in effect a domestic carbon tax on companies such as Ford and Archer-Daniels because they would have to pass it on to their foreign suppliers. The proposal comes from progressive congressional Democrats, which appears to be a handicap. It also has significant flaws, including a loophole that may subsume the tax entirely.

Foreign border tax applies to US companies

A US carbon tax on foreign companies appears inevitable, but the border adjustment tax (BAT) in the Clean Competition Act (CCA), S. 4355, is a levy on US companies, not foreign ones. The CCA would apply a $55-per-ton charge on US importers for a range of products including fossil fuels, chemicals, fertilizer, steel and paper. US companies from Ford (on steel) to Archer-Daniels (on fertilizers) would experience higher costs. Under the proposal, the US would determine whether, and to what extent, the BAT applies to imports. US importers would be responsible for passing the cost on to the foreign seller.

Imports from high-polluting countries would be made more expensive and those from nations with fewer emissions comparatively cheaper. That won’t work for products like fertilizer that aren’t made in low-polluting countries.

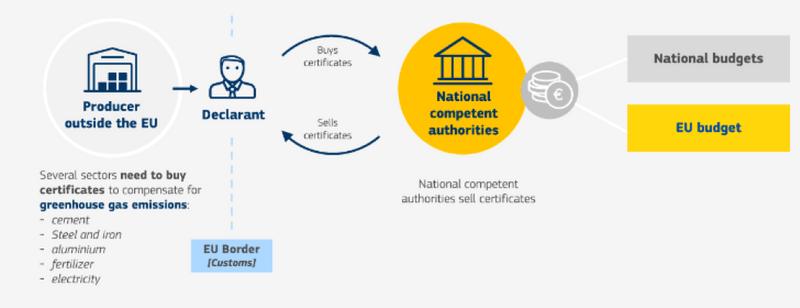

US BAT could look a little like the EU’s CBAM

Loophole appears poised to aid intermediaries

The BAT contains an exception that could make companies located in less-developed countries more profitable. It exempts products produced by companies located in “a relatively least developed country,” using a list based on United Nations data. China, where the US had applied tariffs for allegedly dumping solar panels into the US, has now been accused of evading those levies by routing its products to the US through companies such as New East Solar Energy, Jintek Photovoltaic Technology and Enalex Energy in Cambodia. The BAT would apply to Chinese or Indian companies, but not to those from Cambodia and Laos, even if the products are originally derived from China or India.

As the solar-panel trade issue has shown, determining the origin of an import, or elements of an import, is exceedingly difficult.

US carbon tax will happen, just not yet

The US will adopt a BAT, but it likely needs to come from congressional Republicans to attract widespread support. We think the application of the carbon border adjustment mechanism, the EU’s BAT, will drive the US to adopt its own version. But the CCA is a proposal from congressional progressives and that will make it tough to pass in this Congress, regardless of its merits. The same proposal from congressional moderates or conservatives would garner far more support. Additionally, a Republican BAT would, we believe, be protective of US companies and use a market-based carbon pricing system, unlike the CCA which generally uses the opposite approach.

Bloomberg Intelligence September 07, 2022

https://www.bloomberg.com/professional/blog/us-proposed-import-levy-looks-like-a-not-so-disguised-carbon-tax/